Back to Basics: Entrepreneurs' Relief

I’ve been chatting with business owners about the impact of the recent cut to Entrepreneurs’ Relief and there seems to be a common consensus that this was a step too far.

Given that it is entrepreneurs who take on the significant risk in setting up and growing a business that might employ 10, 50 or 100+ employees (indirectly taking on the risk of their livelihoods too!), a £10m lifetime gain sheltered with a 10% tax rate provided a fair and reasonable incentive or trade-off.

£1m just doesn’t quite cut it for all of the sweat and tears - especially when you take into account that SEIS / EIS investors will be able to exit capital gains tax free!

What are your thoughts?

Back to Basics: Entrepreneurs’ Relief

Given all the news about Entrepreneurs’ Relief (ER) in the Budget, I thought it might be worth revisiting the qualifying criteria for ER in the context of director shareholders.

The sale of shares in a company is subject to capital gains tax. The current main rates of capital gains tax are 10% for basic rate band income and 20% thereafter (the rates on residential property are 18% and 28% respectively).

To encourage entrepreneurs to build successful businesses, ER was introduced in 2008 to apply a beneficial rate of 10% on the first £1m of lifetime gains (until more recently it reached £10m of lifetime gains - so we’ve come full circle).

There are strict qualifying conditions for ER to apply to the sale of shares. Mucking this up can be very expensive (although less so, as of 11 March 2020 ;) ).

The exiting shareholder must be a director or employee of a trading company (or holding company of a trading group) and they must own at least 5% of the ordinary share capital carrying at least 5% of the voting rights and satisfy one of two economic tests * for the two years leading up to the date of disposal

* More on the ‘economic tests’ another time as it’s too much to cover here but in a nutshell, you should be able to demonstrate that you are entitled to:

at least 5% of the profits or assets on a wind up (test 1); OR

at least 5% of the proceeds on a sale of the entire company (test 2 - this latter test is newer and is normally invoked where there are different classes of shares as test 1 proved problematic in these situations).

This is only a brief summary but at least you get the sense of how complex this can be - but the savings are worth it.

Mitigating Entrepreneurs Relief CGT shortfalls

Next week, I will cover a way of mitigating the newly introduced shortfall in entrepreneurs’ relief to allow you to potentially sell your shares for £zero capital gains tax (CGT). Unfortunately, this can’t be applied retrospectively.

So if you could start over again or perhaps for your next or side venture, this could be important…

I’ll also cover ways of sheltering those latent capital gains that you may now have to suffer at 20%. Stay tuned.

If you haven’t already subscribed, you can do so below:

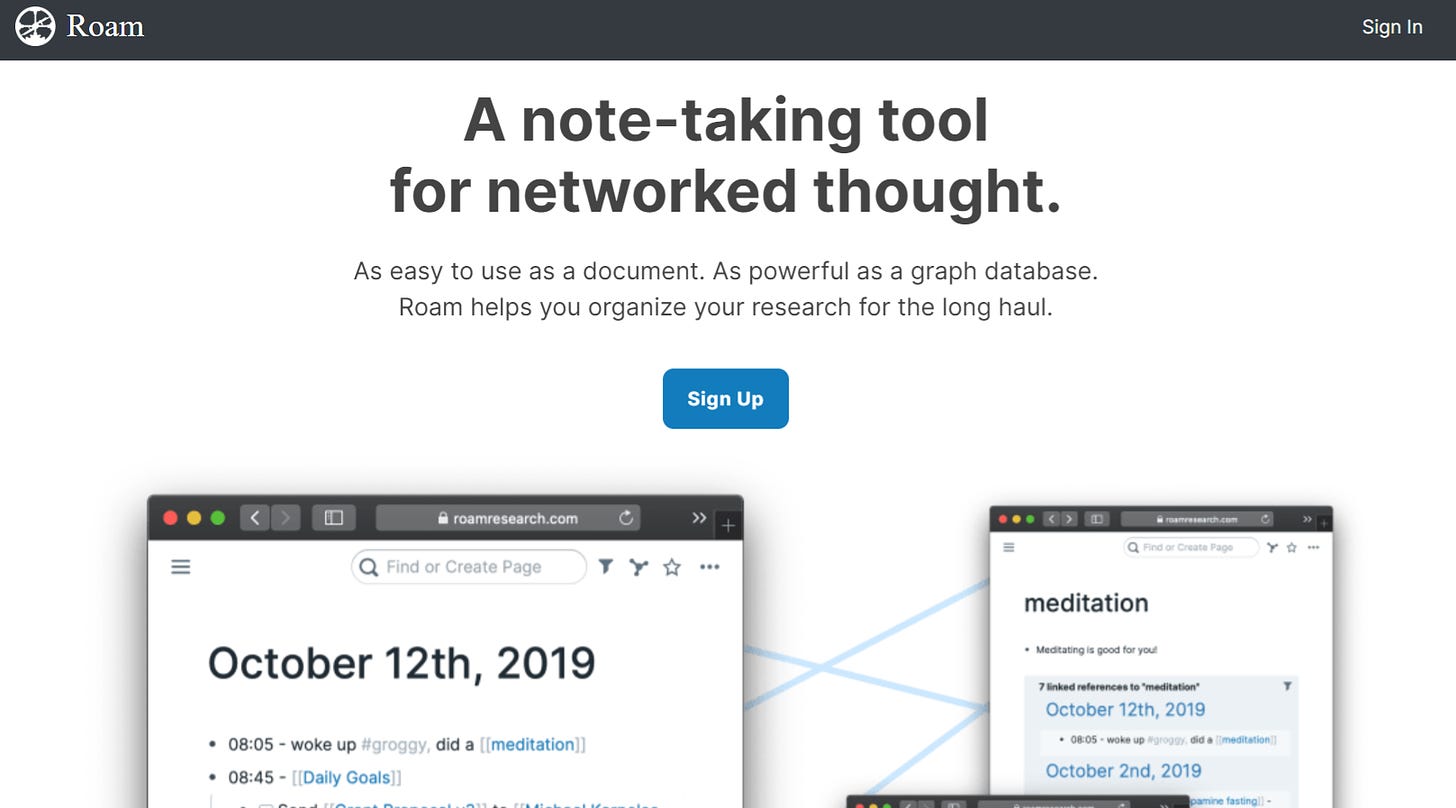

Favourite new app: Roam Research

I am finding this web app called Roam Research super useful for connected / smart note-taking.

You can properly geek out on its subtle yet significant capabilities by playing around with it (currently free) and maybe get some inspiration from articles like this.

If you like Evernote or Notion, I have little doubt that you’ll love this too.

What app couldn’t you live without right now?

Toon of the Week

It’s Friday so we need a ‘toon of the week’ - here’s mine from the Gorillaz:

Please share your top ‘toons’ for next week!

Until then, have a great weekend!

Steve